Discover the top 10 investment tips for success in Crypto, Stocks, and Real Estate. Learn how to diversify your portfolio, manage risks, and maximize returns in these lucrative asset classes.

Investing is one of the most effective ways to build wealth over time. However, the world of investments can be overwhelming, especially with the variety of options available today. Whether you’re interested in Crypto, Stocks, or Real Estate, each asset class has its own unique advantages, risks, and strategies. In this comprehensive guide, we’ll explore the top 10 investment tips to help you succeed in these three major investment avenues. By the end, you’ll have a clear understanding of how to diversify your portfolio and maximize returns.

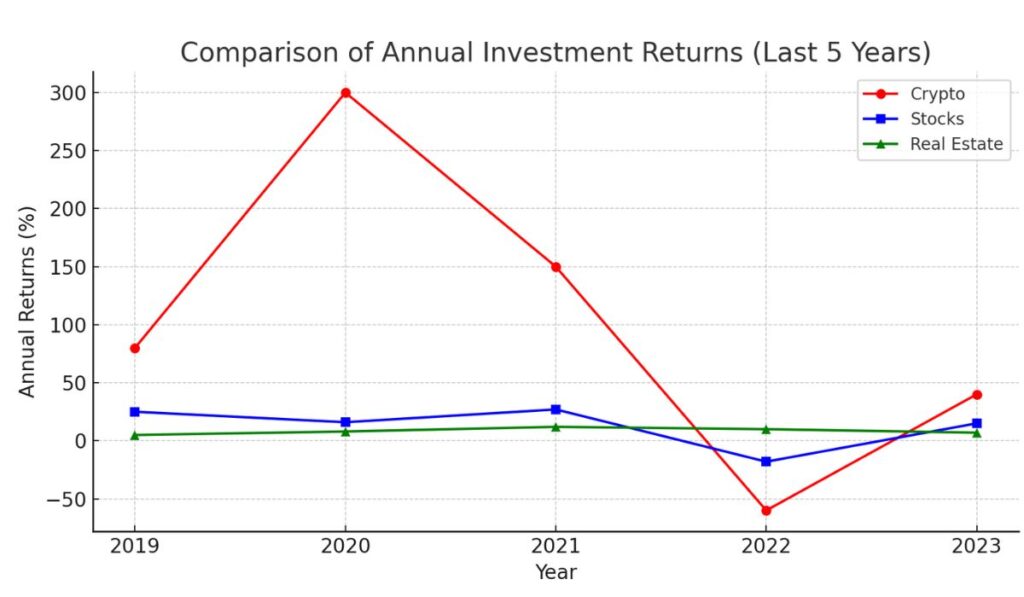

Here is the graph comparing the annual returns of Crypto, Stocks, and Real Estate over the last five years

Introduction to Crypto, Stocks, and Real Estate

Crypto

Cryptocurrencies like Bitcoin, Ethereum, and Solana have revolutionized the financial world. Crypto is a digital asset that operates on blockchain technology, offering decentralization, transparency, and high potential returns. However, it’s also highly volatile and speculative.

Stocks

Stocks represent ownership in a company. When you buy stocks, you become a shareholder and can benefit from capital appreciation and dividends. The stock market is one of the most traditional and well-established investment avenues, offering a balance of risk and reward.

Real Estate

Real estate involves investing in physical properties like residential homes, commercial buildings, or land. It’s a tangible asset that provides steady income through rent and long-term appreciation. Real estate is often considered a safer investment compared to crypto and stocks but requires significant capital and management.

Top 10 Investment Tips for Success

Tip 1: Diversify Your Portfolio

Diversification is the key to reducing risk and maximizing returns. Don’t put all your eggs in one basket. Allocate your investments across Crypto, Stocks, and Real Estate to balance potential gains and losses. For example:

Invest 40% in stocks for steady growth.

Allocate 30% to real estate for stable income.

Dedicate 10-20% to crypto for high-risk, high-reward opportunities.

Tip 2: Do Your Research

Before investing, thoroughly research the asset class. For Crypto, understand the technology, use cases, and market trends. For Stocks, analyze the company’s financial health, industry position, and growth potential. For Real Estate, evaluate location, property value trends, and rental demand.

Tip 3: Understand Risk Tolerance

Your risk tolerance depends on your financial goals, age, and investment horizon. Crypto is high-risk but offers high returns, making it suitable for aggressive investors. Stocks are moderate-risk, ideal for those seeking balanced growth. Real Estate is low-risk and perfect for conservative investors.

Tip 4: Invest for the Long Term

Long-term investing minimizes the impact of market volatility. Historically, Stocks and Real Estate have shown consistent growth over decades. Even in Crypto, holding assets like Bitcoin for the long term has proven profitable despite short-term fluctuations.

Tip 5: Stay Updated on Market Trends

Markets are dynamic, and staying informed is crucial. Follow news, trends, and expert analyses for Crypto, Stocks, and Real Estate. For example:

Monitor regulatory changes in the crypto space.

Track earnings reports and economic indicators for stocks.

Keep an eye on interest rates and housing market trends for real estate.

Tip 6: Use Dollar-Cost Averaging

Dollar-cost averaging (DCA) involves investing a fixed amount regularly, regardless of market conditions. This strategy reduces the impact of volatility and is particularly effective for Crypto and Stocks. For example, invest $100 in Bitcoin or an S&P 500 ETF every month.

Tip 7: Leverage Professional Advice

Consult financial advisors, portfolio managers, or real estate agents to make informed decisions. Professionals can provide personalized strategies based on your goals and risk tolerance.

Tip 8: Avoid Emotional Decision-Making

Emotions like fear and greed can lead to poor investment decisions. Stick to your strategy and avoid panic-selling during market downturns or over-investing during bull runs.

Tip 9: Monitor Your Investments Regularly

Regularly review your portfolio to ensure it aligns with your goals. Rebalance your investments if necessary. For example, if Crypto has grown significantly, consider reallocating some profits to Stocks or Real Estate.

Tip 10: Reinvest Your Profits

Reinvesting profits can accelerate wealth growth. Use dividends from Stocks, rental income from Real Estate, or gains from Crypto to purchase additional assets.

Comparison Table: Crypto vs. Stocks vs. Real Estate

| Aspect | Crypto | Stocks | Real Estate |

|---|---|---|---|

| Risk Level | High | Moderate | Low |

| Liquidity | High (easy to buy/sell) | High (easily tradable) | Low (takes time to sell) |

| Potential Returns | Very High | Moderate to High | Moderate |

| Investment Horizon | Short to Long Term | Long Term | Long Term |

| Income Generation | None (unless staking or lending) | Dividends | Rental Income |

| Capital Required | Low | Low to Moderate | High |

| Volatility | Extremely High | Moderate | Low |

| Tangibility | Intangible | Intangible | Tangible |

| Regulation | Evolving | Well-Regulated | Well-Regulated |

Investing in Crypto, Stocks, and Real Estate can be highly rewarding if done strategically. By following the top 10 investment tips outlined in this guide, you can build a diversified portfolio that balances risk and reward. Remember to stay informed, avoid emotional decisions, and seek professional advice when needed. Whether you’re drawn to the high returns of Crypto, the stability of Stocks, or the tangible benefits of Real Estate, a well-rounded approach will set you on the path to financial success.

Very informative blog I love it